ECB research shows that more than one-fourth of low-income households expect late payments on their mortgages in the coming months.

An increasing number of low-income Europeans are expecting to be late paying key bills over the coming months because of a rise in interest rates, rents and utilities costs, according to research by the European Central Bank (ECB).

"The ability of households to meet their housing-related costs and mortgage payments is a source of concern, especially for lower-income households," the researchers wrote in an ECB economic bulletin article providing a snapshot of the "household housing burden" in the largest 11 eurozone economies.

Since the ECB started to raise interest rate in July 2022, overall housing costs were up by 6% for outright owners, but by 12% and 9% for mortgagees and renters respectively, the report from Omiros Kouvavas and Desislava Rusinova revealed.

In January 2024, households were paying an average of €765 per month in total housing-related costs, including utilities (such as gas, electricity and water), home maintenance and rent or mortgage costs, the report found.

Housing costs take up around 40% of income for renters, 35% for mortgagees and 20% for outright owners. Meanwhile, those with the lowest income who have to rent their homes facing paying around half their monthly wage in costs.

Those with a mortgage face the most difficulties

Of the three main categories, those who have a mortgage are facing the highest cost, because of the raised interest rates, with their average monthly payment passing €1,100.

Interest rate hikes have left their imprint on the rental market, too. The raising borrowing costs have halted new investments, while the rental market, which was already facing a shortage of available dwellings, has seen its prices go up accordingly.

Renters are paying more than €800 on average in the 11 countries looked at, according to the ECB, while outright owners are inching towards a cost of €500 a month, mainly driven by rising home maintenance costs. Utility costs have recently eased.

Out of the 11 countries, housing costs appeared to be the highest in Ireland, roughly around €900 a month excluding mortgages, but more than around €1,200 if the mortgage payment is included.

Housing bills are the second and third highest in Germany and Austria, sitting around €750 (€900 with mortgages). People in Greece and Portugal have the lowest housing charges out of the 11 countries.

When the housing costs were examined as a ratio of a household's income, Austria appeared to be the most expensive country, with 29% (33% if mortgages were included in the calculations) of income going on such costs.

How the risk of late payment is increasing

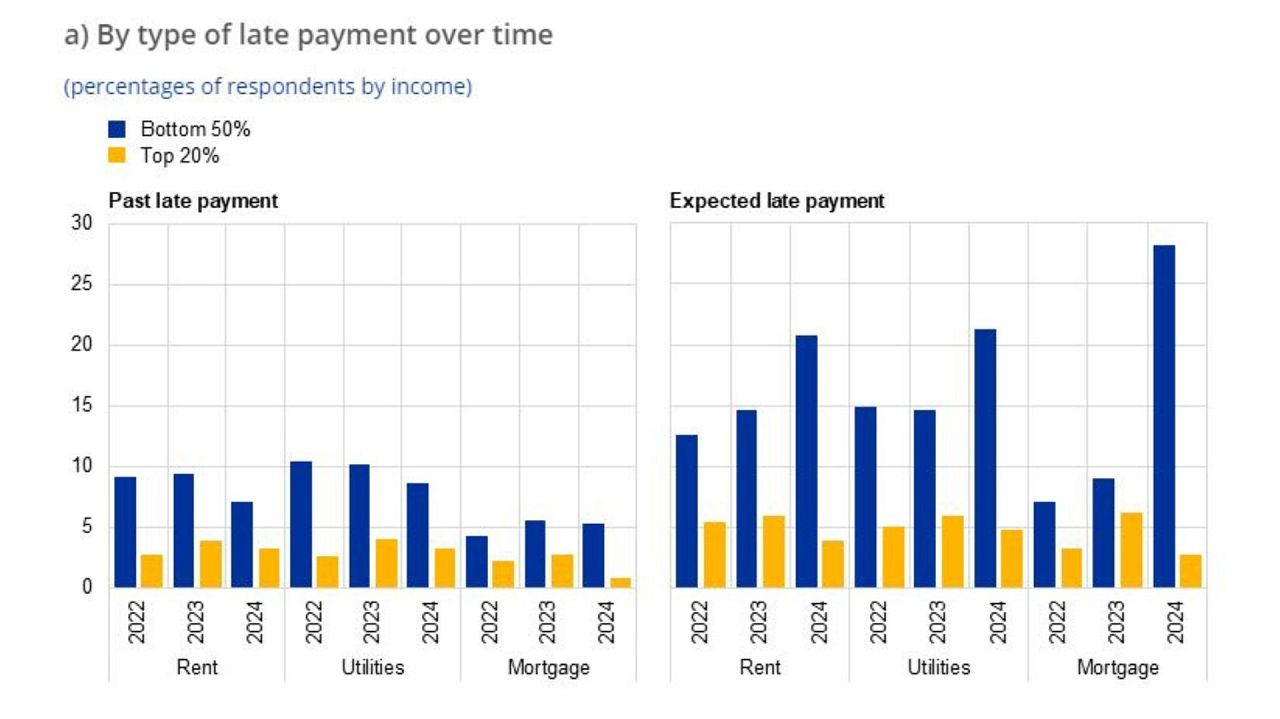

Rising household income has largely offset the rise in housing costs over the past few years although there have always been some low-income households (between 5% and 10% of the lowest-earning 50%) who were late with their payments in the previous months. However, the ECB's forward-looking index now suggests that their expectations for the coming months have worsened.

"The proportion of households expecting to make a late payment in the next three months has risen substantially among lower-income households," the report said.

The ratio of those with low income expecting to be late with their payments for utilities or rent in the next three months rose to more 20% from 15% and nearly doubled to 30% for late mortgage payments.

While inflation is declining in the Eurozone, expectations are high that the ECB is starting to cut its historically high-interest rate in June, bringing some relief to the property market by allowing investments to boost and bring about a wider selection of properties, allowing mortgage and rental costs to soften eventually.